The Final Cost of a Sale Item Is Determined

An example Lets say that you bought a. Taxes are calculated by percentages.

Clothing Shoes Accessories Womens Bags Handbags.

. In the following example calculating the overhead rate for the material overheads is done by dividing the total overhead cost of 30000 by the. 5 005 Sales Tax 005 1721 08605 086 Lastly the Total Cost Sale Price Sales Tax Therefore the total cost of the blue shirt is 1721 086 1807. Total CostPrice including ST.

A It is linear because the ratio of the change in the final cost compared to the rate of change in the price tag is constant. Material costs of respective cost centers. 100 - 30 70 200 100 20000 20000 70 28571.

For an item that costs 100 a 7 sales tax would add an additional 7 because 7 is 7 of 100. Which best It is linear because the ratio of the change in the final cost compared to the rate of change in the price tag is constant. If you have an item thats selling for 100 and you live in a region with a 7 sales tax what that means is the sales tax takes 7 of the price of the product and adds it to the final sale price.

If you received a K-1 and. In case of an item with a price before tax of 100 and a sales tax rate of 5 this tool will return the following results. Today it is on sale for 25 off.

Square footage to arrive at the Final Adjusted Sale Price. If the article you want to buy is 10 percent off of the marked price its easy to figure out. Costs of all items are averaged so an average cost is used both for computing the cost of goods sold and the inventory remaining on the balance sheet.

You decide to buy a new sofa for 2540 a coffee table for 629 and a club chair for 1 845. Once you know that its easy to figure out any of the. Multiply number of items at list price by list price.

You are paying 60 and youll get 4 items. The most recent purchases are the first to be sold recorded as cost of goods sold so the oldest costs remain on the balance sheet as inventory. Regular list price is 20.

Subtract the discount from 100 to get the percentage of the original price. There is no sales tax on the cereal. Sales Tax Sales Tax rate Sale Price In our example we found the Sale Price to be 1721 and we will use a Sales Tax rate of 5.

If you purchase anytthing this weekend you do not pay the 9 sales tax on items. Multiply the final price by 100. The final cost of a sale item is determined by multiplying the price on the tag by 75.

Sale is 4 items for the price of 3. Which best describes the function that represents the situation. D 25.

If the list price of an item is 120 and the final sale price is 90 then discount is calculated as follows. The equation looks like this. D L S L 100.

D 30 120 100. Once the Final Adjusted Sale Price has been determined it will be compared to other comps used in the process to arrive at an overall range of values determined through the process of RECONCILIATION in. If the scarf originally cost 12 and its now 10 percent off that price simply subtract 120 from 12.

129 if total amount of the sale is 7500 or less calculated per item. 7 if total amount of the sale is over 7500 calculated per item. Item or service cost x sales tax in decimal form total sales tax.

Calculating overhead costs. A box of cereal normally costs 456. D 120 90 120 100.

The final cost of a sale item is determined by multiplying the price on the tag by 75. You only report the sale from 1099-B. Discounted price per item Number of items at list price x list price Number of items in discount deal.

Determine the final cost of an item Including Sales Tax and Discounts Question The grocery store is having a sale on cereal. Once youve calculated sales tax make sure to add it to the original cost to get the total cost. 15 if total amount of the sale is 2000 or less calculated per item.

For example if the sale price of an item is 200 and it was discounted by 30 percent then. Divide by the percentage in Step One. If you buy 4 boxes of cereal how much money will you have to pay at the register.

Calculating Total Cost Multiply the cost of an item or service by the sales tax in order to find out the total cost. This gives you the net sales price. In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return these results.

Convert the 5 to a decimal. 9 if total amount of the sale is over 2000 calculated per item. D 025 100.

Regarding sale information for a schedule K-1 is the Sale Price the total amount I sold my shares for and the Partnership Basis the original cost of purchasing shares. Finally divide the gross price by the sales tax rate plus one. The Market Conditions Adjusted Normal Sale Price is then adjusted for physical differences eg.

Determine the Final Cost of an Item Including Sales Tax and Discounts Question Bobs Furniture Barn is having a sale on all their inventory for Labor Day. To calculate overhead costs simply divide the total by the calculation base with the latter referring to the direct costs eg. Amount Saved 120 90 30.

Boho Printed Cotton Kilim Area Rug 3ft X 5ft In 2021 Kilim Area Rug Boho Print Printed Cotton

Oem Stainless Steel License Frame Jeep Final Sale In 2022 License Frames Blowout Sale Stainless Steel

Artistic Accents Gold Metallic Napkins 6 Pc Set Gold Metal Metal Sale Items

Oem Stainless Steel License Frame Cts Final Sale Etsy In 2022 License Frames Blowout Sale Oem

Adorable Silver Anklet 6 Final Price Silver Anklets Anklet Silver

Ofra Glow Up Highlighter Palette In 2022 Highlighter Palette Glow Up Highlighter

Oem Stainless Steel License Plate Buick Final Sale Etsy In 2022 Steel License Plate Stainless Steel Plate

Sample Park Black 002 In 2022 Sample Sale Sample Classic Pieces

Oem Stainless Steel License Frame Ford Explorer Final Sale In 2022 License Frames Car Frames Steel

Apply Percents Distance Learning Middle School Math Resources Collaborative Learning Activities Distance Learning

Friends Photo Frame Ornament In 2021 Ornament Frame Photo Frame Ornaments Ornaments

Final Sale Silver Filled Open Jump Rings 4mm 20 Gauge 24 In 2021 Silver Filled Open Jump Rings Silver

Sample Park Black 001 In 2022 Bag Handle Sample Sale Classic Pieces

Ofra Glow Up Highlighter Palette In 2022 Highlighter Palette Glow Up Highlighter

Galentine S Day Starts Now Buy A Full Price Item Get A Sale Item For Free Bring A Friend Or Have It All For Yourself V Free Items Galentines Sale Items

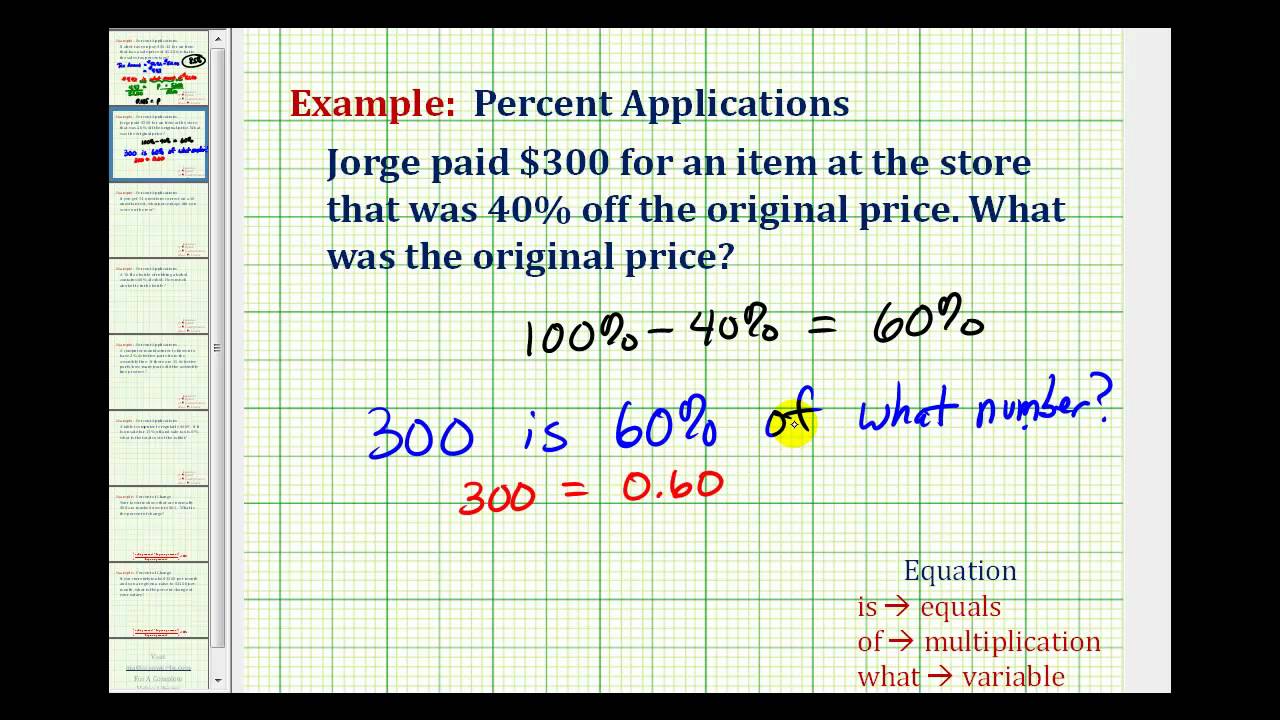

Ex Find The Original Price Given The Discount Price And Percent Off Youtube Percents The Originals Education

Comments

Post a Comment